News

Early Voting Dates and Times Set for August 4th Elections

June 14, 2022

By: Dwayne Page

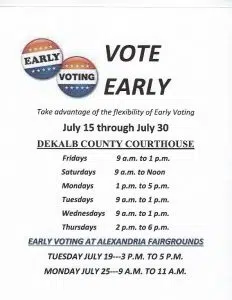

The times for early voting have been set for the upcoming August 4 DeKalb General and State Primary Elections.

Early voting begins July 15 and runs through July 30,

The DeKalb County Election Commission unanimously voted Monday night to set the following hours at the DeKalb County Courthouse in Smithville: Mondays 1 p.m. to 5 p.m.; Tuesdays 9 a.m. until 1 p.m.; Wednesdays 9 a.m. until 1 p.m.; Thursdays 2 p.m. to 6 p.m.; Fridays 9 a.m. until 1 p.m. and Saturdays 9 a.m. until Noon.

Early voting will also be held again in the western part of the county on a limited basis. The DeKalb County Fairgrounds will be the site of early voting on July 19th from 3 p.m. to 5 p.m. and on July 25 from 9 a.m. until 11 a.m.

“The election commission is proud to again offer early voting in Alexandria during this election cycle,” said Dennis Stanley, Administrator of Elections. “And voters are also reminded of yet another convenience this time around—early voting on three Saturdays from 9 a.m. until noon.”

Each early voting site is for any properly registered DeKalb County voter.

Voters are reminded they have two options for the August elections. They can vote in the DeKalb County General Election only or they can add one of the state primaries (Republican or Democrat).

“On the county general election, Democrats, Republicans and Independents are listed on the same ballot and voters can choose to vote for a Republican in one race and a Democrat or Independent in another,” Stanley said. “However, when it comes to the state primary, voters must choose one party or the other and that election has no bearing on the County General. Whichever state primary a voter chooses, the County General ballot will be included.”

Meanwhile, the voter registration deadline for the August elections is July 5.

DeKalb Fair Returns July 11-16 Dedicated to Hometown Heroes

June 14, 2022

By: Dwayne Page

The DeKalb County Fair returns for its annual weeklong run Monday through Saturday, July 11-16.

With the theme “Hometown Heroes This Fair is For You in 2022″, the 166th edition will feature another fun filled week of rides by B&K Carnival and many crowd pleasing activities and events including the Demolition Derby, ATV/Motorcycle Racing, Super Truck & Tractor Pull, the Lip Sync Battle, Car Show, Grill-Off and Ice Cream Contest, Poultry, Cattle, Goat, and Pet Show, Hay Decorating, and much more. Cash drawings will be held each night.

DeKalb Fair President Matt Boss said this year’s fair is dedicated to “Hometown Heroes”.

“The Fair Board decided that we wanted to recognize the Hometown Heroes of DeKalb County and dedicate each night of the fair to them including our fire departments, police departments, sheriff’s department, military, highway patrol, rescue squad and other people we consider Hometown Heroes in DeKalb County,” said Boss.

The 2022 DeKalb County Fair Premium Book is now available and copies can be obtained at the following locations: Alexandria: Prichard’s Foods, The Village, Alexandria Post Office, Alexandria Senior Center, City of Alexandria, Wilson Bank & Trust, Liberty State Bank and Junk and Jewels; Liberty: Liberty State Bank and Liberty Post Office; Dowelltown: Dowelltown Post Office; Smithville: UT Extension Office, USDA Farm Services Office, Smithville Senior Center, F.Z. Webb’s & Sons Pharmacy and Soda Fountain, FirstBank, Liberty State Bank, Regions Bank, Wilson Bank & Trust, Smithville Review, Smithville Post Office and DeKalb County Register of Deeds Office.

http://www.dekalbcountyfairtn.com/premium_book

Non-perishable items for display in the Kenneth Sandlin Center will be accepted on Saturday July 2 from 10 a.m. until 2 p.m. and on Saturday July 9 for perishable entries from 10 a.m. until 2 p.m.

The schedule of Fair events each night is as follows:

Monday, July 11:

*Cattle Show at the Ag Center- 6:00 p.m.

*Demolition Derby at the T.C. McMillen Arena- 7:00 p.m.

*Junior Fair Princess Pageant for contestants ages 13-16 at 6:00 p.m. followed by the Fairest of the Fair Pageant for contestants ages 17 to 20 at the Lions Club Pavilion

*Miss Fair Queen for contestants ages 21-54 at the Lions Club Pavilion following the Fairest of the Fair Pageant

*Lip Sync Battle (Round 1) at the Lions Club Pavilion following the Miss Fair Queen

*Cash Drawing-9:30 p.m. at the Lions Club Pavilion

Tuesday, July 12:

*Little Mister for contestants ages 4-6: 6:00 p.m. at the Lions Club Pavilion

*Little Miss for contestants ages 4-6 following the Little Mister Pageant

*Mrs. Fair Queen for contestants up to age 54 at the Lions Club Pavilion following the Little Miss Pageant

*Miss Senior Fair Queen for contestants ages 55 and older at the Lions Club Pavilion following the Mrs. Fair Queen Pageant

*Corn Hole Tournament: 7:00 p.m. at the Ag Center

*ATV/Motorcycle Racing: 7:00 p.m. at the T.C. McMillen Arena

*Cash Drawing-9:30 p.m. at the Lions Club Pavilion

Wednesday, July 13:

*Cooking Lamb: 6:00 p.m. at the Ag Center (First Come, First Served)

*Little Miss Princess Pageant for contestants ages 7-9: 6:00 p.m. followed by the Miss Sweetheart Pageant for those ages 10-12 at the Lions Club Pavilion

*Kiddie Tractor Pull: 7:00 p.m. at the Ag Center

*Cash Drawing-9:30 p.m. at the Lions Club Pavilion

Thursday, July 14:

*Senior Day: 9:00 a.m. at the Ag Center

*Junior Goat Show: 6:00 p.m. at the Barn

* Baby Show for contestants one day to 12 months: 6:00 p.m. at the Lions Club Pavilion followed by youthALIVE

*Cash Drawing: 9:30 p.m. at the Lions Club Pavilion

Friday, July 15:

*Toddler Show for contestants 13 months to 48 months: 6:00 p.m. followed by Lip Sync Battle (Finale) at the Lions Club Pavilion

*Farmer for a Day: 6:00 p.m. at the Ag Center

*Homemade Ice Cream Contest: 6:00 p.m. at the Ag Center

*ATV/Motorcycle Racing: 7:00 p.m. at the T.C. McMillen Arena

*Cash Drawing-9:30 p.m. at the Lions Club Pavilion

Saturday, July 16:

*Grill-Off Competition: 2:00 p.m. at the Ag Center

*Car Show: 2:00 p.m. Registration and judging at 3:00 p.m.

*Gospel Singing: 6:00 p.m. at the Lions Club Pavilion

*Pet Show: 5:00 p.m. at the Ag Center

*Super Tractor/Truck Pull: 7:00 p.m. at the T.C. McMillen Arena

*Cash Drawing-9:30 p.m. at the Lions Club Pavilion

Take a stroll down Memory Lane which features replicas of Prichard’s Motors, DeKalb Telephone Cooperative, Jennings’ Barber Shop, DeKalb Community Bank, Alexandria Drug Store, Jennings Produce, Alexandria Mercantile, and DeKalb County Fair Veterans Building.

Enjoy Memory Lane Stage Entertainment which includes Body Boutique by “B” Monday night at 6:00 p.m.; Hart & Gold Permanent Jewelry & Bag Bar Tuesday night; Outreach Kids Choir at 6:00 p.m. Wednesday night; and Susan England at 7:00 p.m. on Friday night. More acts to be booked later.

Rides on the Midway will be provided by B&K Carnival. Unlimited rides will be available for $20.00 on Monday night through Thursday night and $25.00 on Friday night and Saturday night.

Admission to the fair is $5.00 per person. Children age four and younger will be admitted free! Gates and Midway open at 4:30 p.m. Monday through Friday and at 4:00 p.m. on Saturday. The exhibit building is open from 5:00 p.m. until 9:30 p.m. Monday through Friday and Saturday from 4:00 p.m. until 9:30 p.m.

Visit the DeKalb County Fair website at the link below for information about renting booth space, being a sponsor, entering pageants and shows, entering exhibits and events. The contact person and phone number for all of these are listed on the website at

www.dekalbcountyfairtn.com/

Pre-K Applications Still Available at Ernest Ray Education Center

June 14, 2022

By: Dwayne Page

Any parent interested in applying for the Pre K program for their child may pick up an application at the DeKalb County Board of Education central office (Ernest Ray Education Center) downtown.

What will parents need for Pre-K registration?

Parents will need COPIES of these items: Proof of income for all household members, certified copy of birth certificate with the state seal, proof of residence in DeKalb County (i.e. gas/electric bill), and a current, up to date, physical examination and immunization record (These must be on a Tennessee Department of Health Certificate of Immunization, which can be obtained from your doctor’s office or the Health Department).

***Students must turn 4 on or before August 15, 2022 to enroll in Pre-K for the 2022-2023 school year.

If you have questions, please call Michelle Burklow at 615-597-4084.

The DeKalb County School System is receiving a grant in the amount of $489,179 from the Tennessee Department of Education to fund five voluntary Pre-K classes to serve up to 100 students for another year including four Pre-K classes at Smithville Elementary and one class at DeKalb West School.

« First ‹ Previous 1 790 880 888 889 890891 892 900 990 2615 Next › Last »