News

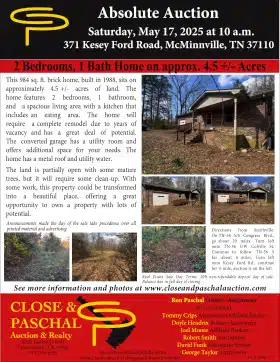

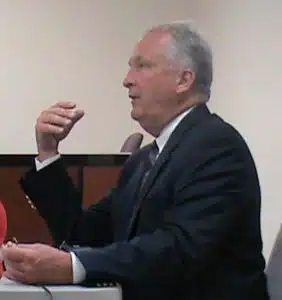

Bates advises Budget Committee to leave debt service tax rate as is to fund construction of jail and another new school in the future

May 14, 2025

By: Dwayne Page

The county’s fiscal agent, Steve Bates, met with the budget committee for the first time this year Tuesday night to give his assessment of the 2025-26 fiscal year budget as proposed and to offer some advice for the future.

“The budget as presented (with many budget requests left out) is as good as any budget I’ve seen us do here. We could be off five percent on expenditures and three percent on revenues and still have a balanced budget,” said Bates.

The county general fund was projected to go into cash by the end of the 2024-25 fiscal year to the tune of $854,000 but as of Tuesday, May 13, 2025 the fund showed $3.1 million in budgeted but unspent money for the 2024-25 fiscal year. County officials said it is unlikely that all of that money will be expended by June 30, 2025.

For the 2025-26 fiscal year, the county general fund is projected to go into cash by $1,014,586 if all anticipated revenues come in and every penny budgeted is spent.

Bates said that too is unlikely.

“On a budgetary basis, theoretically we (county general) could be in the hole (going into cash) every year. But we keep a strong fund balance in the general fund just to meet cash flow,” he said.

Last year, the county commission adopted a budget with a 51-cent property tax increase for debt service (0.6160 total) to fund construction of a jail/judicial center through the issuance of bonds not to exceed $65 million. But that project failed to move forward after it was soundly defeated at the polls in a public referendum in November. Still the 51-cent tax increase remains as part of the overall tax rate of $2.51 per $100 of assessed value.

In February 2025 the county commission voted to adopt a detailed bond resolution not to exceed $55 million to fund construction of a new 800 student Pre-K to 2nd grade elementary school (adjacent to Northside Elementary School). The term of the bond is for up to 30 years. The projected cost to build the new 124,207 square foot facility at the latest estimate is $53,414,825. Construction has not yet begun.

The new school will be funded only by revenues from local option sales tax money (local purpose/sinking fund) designated for school construction and operation. No county property taxes will be used to fund it.

Although no further tax increase is needed, Bates is recommending that the county keep the tax levy the same (0.6160 for debt service) to not only fund a jail project but future school construction.

“You have a jail to build, and you will need to do short term borrowing for that,” Bates explained. “We don’t have a choice because there’s another school coming after this (elementary) school. As time goes on, the expenditures you are spending now on putting inmates out to other counties, that money will come back once the new jail is built. We can take interest income from capital projects and maybe bank excise income from solid waste, put it in the general fund, and then have the revenue needed to fund the extra positions that the jail requires”.

“In ten years, you are going to build another school. Its coming. You might as well get ready,” said Bates. “We can amortize this jail say over 12 years and get it paid off and then you can build that next school and let that tax levy (0.6160) fund the new school,” he said.

While new elementary school construction is to be supported through the local purpose (local option sales tax) fund, Bates said local purpose is not financially strong enough to support debt payment for two school projects at the same time.

“There is no way sales tax can build two schools,” said Bates. “If you doubled your population and your sales tax doubled you could probably fund a new school but if that happened you would have to build five schools. You are at the jump off point. You have waited too long to build and you’re playing catch up now. We have to look long term and make sure we don’t leave a future county commission in a position you have found yourself in. Let’s get the first school done because when the second school comes if its ten years down the road then you’ll be doing 20-year bonds for that school,” he explained.

Bates also offered another suggestion for the county to consider in support of future new school construction while meeting the state’s maintenance of effort funding requirement for schools.

“They (school board) are budgeting $1.3 million for another piece of land to build a new school (either high school or middle school). I would suggest the county tell the school board to take that out (of their budget) and let the county fund it out of local purpose (local option sales tax revenue) because that fund is supposed to be for things like that,” said Bates.

“They (school board) also need (local option sales tax) cash in their general-purpose school fund to operate on. I would use our restricted cash and let them keep their cash because we have to keep them funded annually at $1,910,000 (from local purpose fund). We are bumping up against the state maintenance of effort (requirement) right now. The more the state gives (schools) the more our (county funding) match goes up. Right now, we are probably within $250,000 or $300,000 of that (threshold) but the good thing is we can count what we are paying in (school) debt toward our local match,” said Bates.

As far as overall debt, Bates added that the county is in good financial condition. “You only owe $925,000. That’s the only debt you owe now,” he said.

The budget committee took no action on Bates’ suggestion. The next meeting of the budget committee will be Thursday, May 15 at 6 p.m. in the lower courtroom of the courthouse.

During the regular monthly meeting last month (April), the county commission voted to ask Treanor Architects and Bell Construction to come up with cost estimates to build a new jail complex at the current site on the public square as well as on a generic green space location. The commission also wants to know what the jail footprint and cost would look like if the county were able to purchase the additional half acre lot adjoining the jail on the east side. No project has been funded or let for bids.

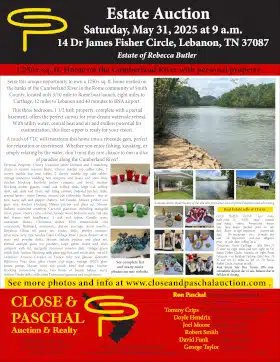

Increased hunting, fishing and boating fees approved in Tennessee

May 14, 2025

By: Dwayne Page

Hunting, fishing and boating in Tennessee will be more expensive for outdoors enthusiasts starting July 1. The Tennessee Wildlife Resources Agency is increasing prices for licenses by 28% on average, across the board.

The decision was voted on by the Tennessee Fish and Wildlife Commission after funding challenges for the state wildlife agency. The agency has cited a Consumer Price Index increase of 32%.

Here are the key details:

Price Increases:Boat registration (vessel renewal) fees will go up by 22%.

Most hunting and fishing license fees will increase by 28%.

Sportsman and Lifetime license fees will increase by 12%.

Structural Changes:

Instead of having supplemental licenses based on device type (gun, archery, muzzleloader), new supplemental licenses will be based on species (deer, elk, bear, turkey, waterfowl).

The trout supplemental license (stamp) will now be included in the base hunting and fishing combination license; no separate stamp needed.

Multiple Wildlife Management Area (WMA) permits have been consolidated into a single WMA permit.

No changes for resident disability licenses or fees for TWRA lakes.

Timing: If you wish to avoid the higher fees, you must renew boats or purchase licenses before July 1, 2025.

Where to Buy: DeKalb County Clerk’s office is an approved location for purchasing hunting and fishing licenses and completing vessel renewals.

A complete list of new fees and permit changes will be posted on the TWRA website prior to July 1, 2025.

“Even coming out of the pandemic, expenses just continued to grow,” said Emily Buck, the TWRA Director of Public Relations. “Our agency we were operating in about a $15 million annual deficit.”

TWRA receives around 70% of its funding through license sales. But, it also asked Governor Bill Lee for an extra boost of $30 million, which was part of the budget proposal. Only $5 million in additional funding was approved.

“While we would have loved to see that $30 million, we fully understand the need for the governor’s office and for the General Assembly to create a budget that is sustainable and works for the state,” Buck said.

“And we will take that $5 million and put it to good use.”

The TWRA said it is struggling to staff officers with a limited budget.

“We’ve held approximately 20 law enforcement positions vacant,” Buck said. “Which means if there is a boating accident on the water, we may be slower to respond. If there’s an accident in the field, we may be slower to respond. Poachers may go uncaught.”

Upcoming license fee changes can be found online. Prices will stay at the current rate until July 1.

Other changes include a new law allowing two visibility colors for hunters: blaze orange and blaze pink. Buck said it’s a nod to Tennessee’s prevalent female hunters and anglers.

In addition, Buck said there are some changes to poaching fines and a new license to go into effect in 2026, which would allow deer baiting.

Crop Acreage Reporting Requirements and Deadlines

May 14, 2025

By:

U.S. Department of Agriculture (USDA) Farm Service Agency (FSA) Executive Director Donny Green, in DeKalb and Cannon counties, reminds producers to report planted, prevented planted, and failed acres to establish or retain FSA program eligibility.

For planted crops, the following acreage reporting deadlines are applicable for DeKalb and Cannon counties for the 2025 crop year:

July 15: corn, soybeans, cucumbers, okra, peppers, potatoes, pumpkins, squash, strawberries, tomatoes, watermelons, cantaloupes, peas, and perennial forage (hay and pasture)

July 31: hemp

Aug. 15: green beans

Dec. 15: fall-seeded small grains (wheat)

The following exceptions apply to the above acreage reporting dates:

If the crop has not been planted by the above acreage reporting date, the acreage must be reported no later than 15 calendar days after planting is completed.

If a producer acquires additional acreage after the above acreage reporting date, the acreage must be reported no later than 30 calendar days after purchase or acquiring the lease. Appropriate documentation must be provided to the county office.

If a perennial forage crop is reported with the intended use of “cover only,” “green manure,” “left standing” or “seed,” the acreage must be reported by July 15, 2025.

Producers must report crop acreage they intended to plant but, due to natural disaster, were prevented from planting. Prevented planting acreage must be reported on form FSA-576, Notice of Loss, no later than 15 calendar days after the final planting date, as established by FSA and the Risk Management Agency. According to Green, the Crop Year 2025 final planting date for corn is May 20, 2025, and the final planting date for soybeans is June 15, 2025.

Producers with failed acres should also use form FSA-576, Notice of Loss, to report failed acres. For losses on crops covered by the Noninsured Crop Disaster Assistance Program and crop insurance, producers must file a Notice of Loss within 15 days of the occurrence of the disaster or when losses become apparent. Producers must timely file a Notice of Loss for failed acres on all crops including grasses.

Please visit the DeKalb/Cannon County FSA office or call 615-597-8225 to schedule an appointment to file your crop year 2025 crop acreage report. To find your local FSA office, visit www.farmers.gov .